How to Trade Options on Upstream

Options trading entails significant risk and is not appropriate for all investors.

Upstream is a self-directed trading platform. Upstream does not automatically exercise in-the-money (ITM) options at expiry on behalf of an Upstream trader.

It is the Upstream option holder’s sole responsibility to monitor the market and decide whether to exercise their rights prior to contract expiry, pursuant to the terms of the option or warrant contract held in their Upstream portfolio.

Failure to exercise an in-the-money option or warrant prior to expiry will lead to the loss of the entire investment, i.e., the premium paid, and the loss of any potential unrealized profits-on-exercise.

Upstream shall not be liable for any losses incurred by an Upstream trader’s failure to exercise in-the-money options or warrants prior to expiry.

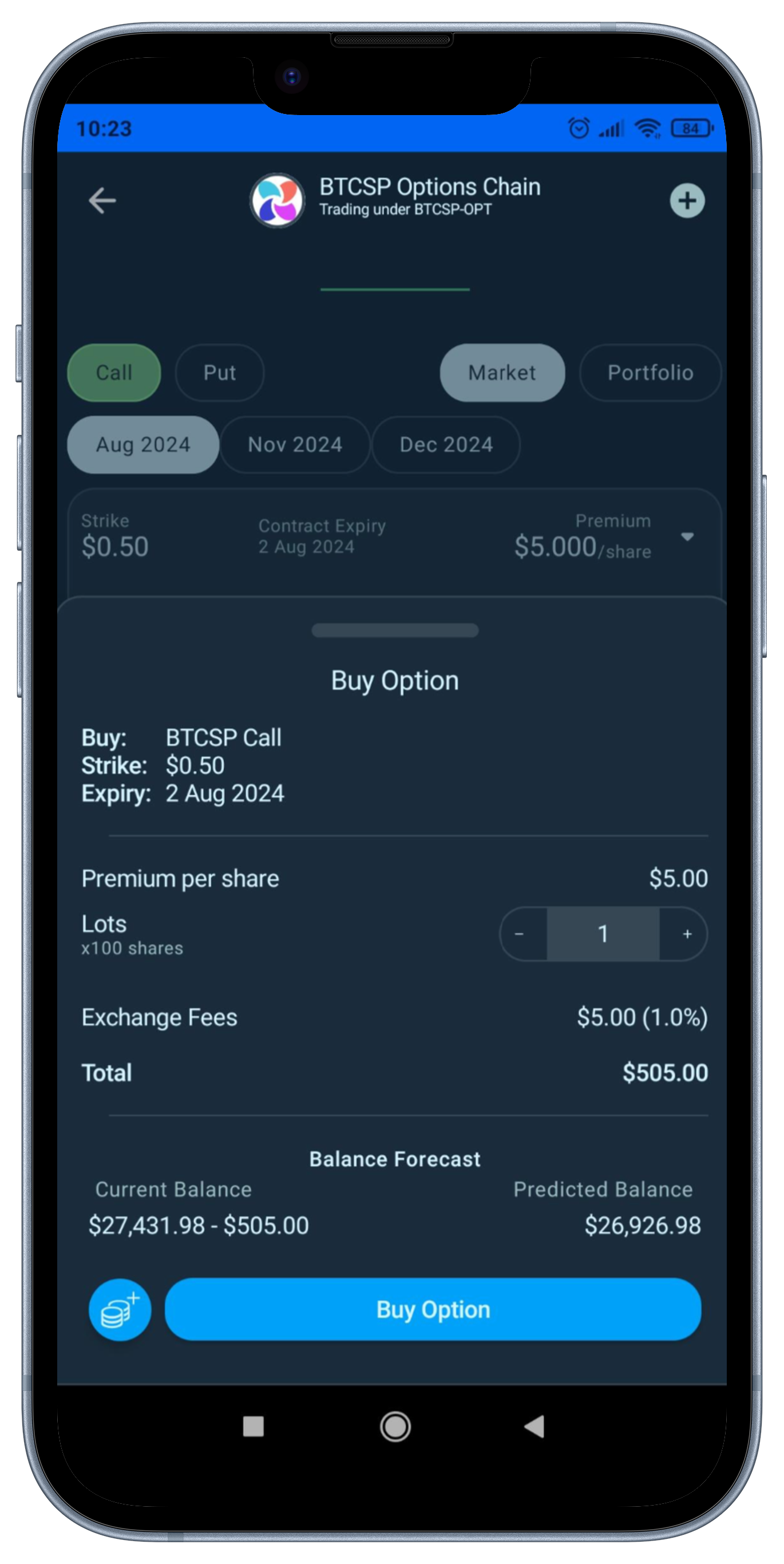

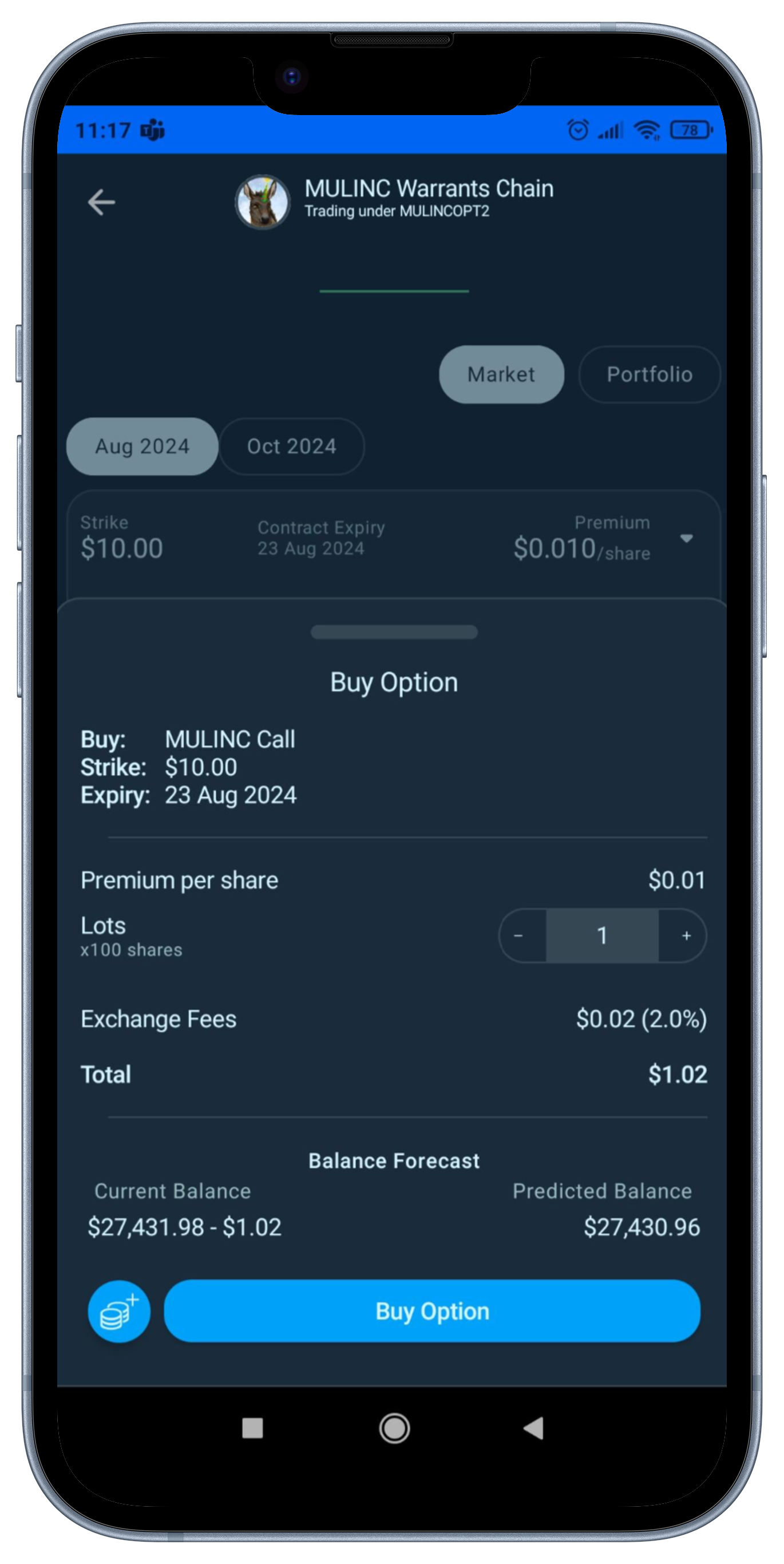

Note, from a trader’s perspective, references to holding Call Options applies equally to holding Call Warrants. Traders should choose to hold the option or warrant that best suit their needs around premium, strike, and expiry.

Upstream does not permit the short selling of equities and does not permit the writing of naked call options or naked put options. However, naming terminology for options participants may sometimes refer to the writer of a covered call, or the writer of a short put, as being “short”.

Therefore, (i) writing covered calls (or call warrants) on Upstream requires the underlying assets to be held, and blocked from onward sale, ensuring the option writer (or warrant issuer) is never short stock, and (ii) writing puts requires that sufficient cash is held, and blocked from onward use or withdrawal, ensuring the writer is never short cash, to meet their obligations should their option or warrant be assigned prior to expiry.

If the holder of an option or warrant exercises their right to buy (call) or sell (put) stock, Upstream guarantees that the shares (call) and the cash (put) is available without delay and will settle immediately upon exercise.

Upstream does not permit Long-Term Equity Anticipation Securities (LEAPS), i.e., options contracts with an expiration date longer than one year.

Upstream permits call warrants with an expiration date longer than one year, however, such warrants may not be used to collateralize the writing of a covered call option (i.e., synthetic covered call or poor man’s covered call).